Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

In speech therapy private practice, there are two things that really matter if you want to stay profitable (and open for business). In this episode, I discuss revenue and expenses and the importance of managing the flow of money coming into and out of the practice.

In this episode:

02:00 – Listener Statistics

02:40 – Staying Connected

03:45 – Revenue & Expenses

04:18 – Profit & Loss

05:50 – CPT 92507 Untimed Code

08:20 – Managing Expenses

10:40 – All Access Community

Now with insurance remember in speech therapy we bill the code 92507 that’s what you bill. But don’t forget this goal now 92507 is an untimed code, it’s non-time, it’s not time. So in other words you don’t bill 92507 by the unit, you bill one visit 92507 and that’s it. Unless you have a contract that clearly states that your 92507 is per unit. And I’ve only seen that one time. So again 92507 is a non-time code when you bill that out and you look at your EOB’s when they come back you want to see what your reimbursement rate is and then you want to see how long you’re seeing that patient for because again if you are giving away more time than what you’re bringing in you’re losing money you’re giving away revenue and that’s going to put you in the negative.

[Commercial]Well, Hello everyone! You’re listening to the Speech therapy Private practice Startup Podcast; this is episode number 31. My name is Kyle Meades and I’m a speech pathologist since 1993 and these podcasts are designed to help you improve your business and your life one podcast at a time.

Welcome back to the show everyone. Thanks again for all the emails and all the questions. And as of today today is Sunday October the 29th 2017. We have well over 24,122 listeners to the show and when you break that down all over the world you’re going to find the United States tops the map and then we’ve got Japan and then Australia, the U.K., Canada, Germany, India, South Africa and Singapore. And then when you look at the United States as a whole the top state that listens in the most right now is California, then Texas, New York, Florida, Arizona, Illinois, Pennsylvania, New Jersey and then Maryland. So that’s the distribution of our listeners out there and again if you’re brand new to the podcast. Welcome aboard and I hope you find some good valuable information, if you want to start and grow or scale your own Speech therapy private practice.

And if you go to the front page privateslp.com that main index landing page you’ll see a place there that says “Stay connected”. Go and put your email address in there and I’ll send you some information on Speech therapy private practice events and that may be in your area in the near future. I really don’t send a lot of emails, for those of you who’ve been around since day one and it’s been about three years now so it’s really nice to have you guys still out there listening. But you know I’m not a spammer. I don’t have a lot of corporate sponsorship. I’ve had a few people lately who want to put some advertisements on the Web site. I just decline it. I just don’t want that and I want to keep this free of charge. And for you guys we don’t need a lot of advertisements at the moment so I declined those and so again if you want to stay up to date with Speech therapy private practice and also too there’s going to be a PrivateSLP live event coming up pretty soon so you may want to go ahead and put your name on that list, again privateslp.com.

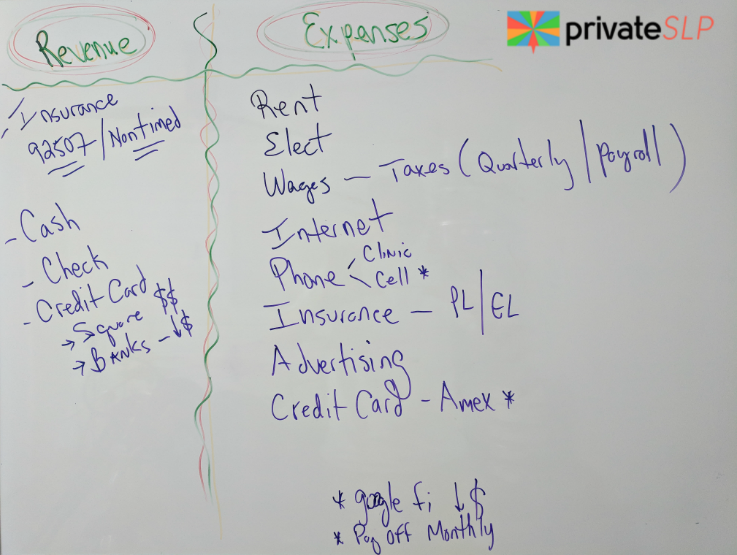

Now I wanted to talk to you today about a very basic model that something I follow on a monthly basis. It’s called Revenue and Expenses. I’m going to take a shot of this white board that I have right in front of me right now for this podcast it’s my notes but I think it’s important for you guys to follow this model. If you want to stay profitable because if you’re not profitable you are no good to yourself or to the patients that you serve.

If you can’t stay profitable you can’t stay in operation. If you can’t stay in operation you’re not going to be in business. So what I wanted to do I wanted to do a podcast on Revenue and Expenses. Now this is something that my CPA we meet once a month and I get what’s called a P&L statement, Profit and loss statements what money comes in and what money goes out. I do this every single month with my CPA and she is really smart and she’s always talking about these things that I’m going to share with you today so free of charge here we go.

Now when it comes to revenue you’ve got a graph, we’ve got revenue on the left and expenses on the right. Now what are some forms of revenue for your own Speech therapy private practice. Well those are payments and those can come in the form of cash or a check or credit card or insurance. Now with cash, Cash is king you hear it all the time.

And if you can go ahead and take the cash. Now also too, our patients write checks in our clinic. We also take credit cards. We started out with square, but square is really really expensive. Its Okay. When you’re doing home visits and you need to have that payment processor when you got your smartphone and you want to go ahead and collect your payments at the time of service in the clinic or in the community so square is an option. But look at Amazon they’ve got a payment platform out there too. It’s a little bit cheaper. Now what we do in our clinics now we have a bank processing through Bank of America and it’s really really affordable. So we’ve saved thousands by switching from square to our own bank processing platform. But again shop around, now that’s the other form of revenue for your clinic.

Now with insurance remember in speech therapy we bill the code 92507 that’s what you bill. But don’t forget this goal now 92507 is a untimed code it’s non-time, it’s not time. So in other words you don’t bill 92507 by the unit, you bill one visit 92507 and that’s it. Unless you have a contract that clearly states that your 92507 is per unit. And I’ve only seen that one time. So again 92507 is a non-time code when you bill that out and you look at your EOB’s when they come back you want to see what your reimbursement rate is and then you want to see how long you’re seeing that patient for because again if you are giving away more time than what you’re bringing in you’re losing money you’re giving away revenue and that’s going to put you in the negative.

So again revenue on one side expenses on the other. Make sure that your revenue exceed your expenses. Now on the other side of the column we’ve got our rate. We’ve got our electricity. We’ve got our wages. We’ve got Internet. We’ve got phone. We’ve got Insurances. And when I say Insurances, professional liability and general liability. What’s professional liability? Well that’s simply insurance that covers you as a practitioner. General liability covers the office. The things like slip and falls or anything like in fire hazards, that’s general liability. Then you’ve got advertising and credit cards.

So just off the top of my head those are some of the major expenses that we have in our office. Now if you look at the third one when it goes down to wages, you have to pay taxes, you have quarterly taxes, and every time you run payroll you’ve got payroll taxes withholding. Now in my clinic I choose to have employees W-2. I don’t really mess around with 1099. That’s because my CPA she’s the smart, when she tells me what to do and I just say yes ma’am thank you. So again we have to pay payroll taxes, we have to pay quarterly taxes, we pay income taxes all that’s in there. Now with the phone we’ve got our clinic phone. We also have our cell phone.

I recently switched my cell phone plan from Sprint to Google Fi. And Google Fi, I encourage you to check out Google Fi on our page privateslp.com. We have a place for services that we use often and there’s going to be a link if you want to click on that and check out Google Fi. I have just found that Google Fi coverage is incredible. The price is about half so for our phone our cell phones in the clinic we use Google Fi we’ve been really happy with it.

Now also to the credit card. I’d like American Express I like my Amex platinum card. The reason is I’ve been a member with American Express since 1993. I get tons of perks. But the main reason is when I need to pay that bill I can’t pay just a little bit. I’ve got to pay it all off so I need that discipline so I choose to use American Express Platinum card services for our business. I do have a city bank card through Costco. It used to be American Express but they switched to Citibank so we have a Costco card for our business and our office manager has one of those and then we have the American Express Platinum card.

So again if you go to privateslp.com/services you’ll see some links there for credit cards and cell phones and things like that if you want to see what we’re using as well. And again I like to pay my balance in full every month. That keeps the credit score up it keeps the cash flow going and so we can stay operational so that patients can get what they need the employees can get what they need. And everybody is happy. So again revenue on one side, expenses on the other. Revenue, you’ve got insurance payments. And again watch your timed codes and non-timed codes. Speech therapy – 92507 that’s a CPT code that we bill out for speech therapy all the time and that’s a Non-timed or un-timed code. Then you get cash as far as revenue then you get checks and credit cards. Expenses – rent, electricity, wages, taxes – quarterly and payroll taxes, Internet phone, clinics cell phones, Insurance – professional liability & general liability, advertising and then credit cards.

If there’s something you think that we may have left off in this podcast go ahead and mention it in the comments section below. But I hope you’re getting some good valuable information out of this podcast and if you need help don’t do it alone. We have a coaching platform where we help people just like you start grow and scale your own Speech therapy private practice. There’s a couple of options there you can take off for a couple of weeks come into Tucson I’ll help you hand in hand. I’ll show you how to set up your own business and get going. Or if he can’t do that we have an online coaching platforms called the all access community. Go ahead and look at that too. And as always if you need help reach out to me at kyle@privateslp.com. And as always thank you for listening.

Hello Kyle!

Thank you for all information you gave. It is so inspirational for me. I changed my career when I moved to the US. I want to open practice in my state. I don’t have the license myself. But I have great experience in managing, marketing and advertising. Also I used to work as SLP in Eastern Europe for 1 year.

Can I hire someone with license to register this type of business? Can the owner of LLC be without education related to this type of business?

Thank you

Yes, non therapists can own therapy clinics.

Can you elaborate on this point? I know that physician (MD offices for example) need to be owned by a doctor. Is it different for SLPs?

Hey Nisha, Not all medical facilities are owned by physicians. Same for therapy clinics.

Starting out is easier being a therapist-owner, however.

I have my BA in speech and language pathology and I am currently working on my Masters. I have worked in the public school system as a SLP/SLPA for 10 years. I have an SLPA license, liability insurance and am applying for my NPI next week. Can I start my own private practice while I am working on my masters?

Two sided answer – Business Side & Service Delivery Side: Business side: You can start some of the private practice startup process with SLPA license; However, You may experience hangups with credentialing, CAQH, PL/GL, Service Delivery Side: You will need a CCC SLP to supervise you, select clients for service, perform EVALS, discharge patients, sign off on notes, etc. I do know an SLPA with a private practice, but she cannot work without the CCC SLP and there is a cost for that CCC SLP.

Do you a general rule of thumb for what percentage of revenue is dedicated to payroll? Occupancy? Utilities?

There is no general rule of thumb because it changes with location. That is why it is highly suggested to ease into the process of adding employees. Payroll can be at least 50-60% % of revenue (even more depending upon market). Rent and utilities can be 10-15%, rent prices change with location, too.

Kyle,

I stumbled upon this page as I am doing research in starting a private practice for my wife who has been an SLP for 5 years now. Is there a way I can have a 1×1 with you to further pick your brain?

Thanks,

Robert

Sure, Privateslp.com